Which of the Following Is an Advantage of Leasing

Which of the following is an advantage of leasing. The lessee may avail 100 finance from lease financing and avoid even initial investment in margin money as required under loan financing.

Sample Texas Residential Lease Agreement Printable Lease Agreement Rental Agreement Templates Being A Landlord

The firm may be able to lease the asset when it does not have the credit capacity to purchase the asset.

. Some leases are not disclosed on the lessees balance sheet. Up front costs may be less. A lease obligation may be substantially more restrictive than the provisions of a bond indenture.

Advantages or benefits of leasing to lessor. Lease payments are likely to be lower than finance payments. The following advantages are available to the lessor.

Lease payment are likely to be lower than finance payment Since a transfer of ownership does not necessarily happen in a lease agreement you could get an item from leasing lower than getting it from finance payment Advertisement Jesusismyfriend. Deferred and recognized as income over the term of the lease. There are lower overall costs for the asset.

100 financing at fixed rates. 2 Automatic ownership interest in the car Unlimited mileage on the car No need to meet credit requirements Lease payments are likely to be lower than finance payments. Which of the following is an advantage of leasing.

Interest rates for leasing are always lower. The cost of the asset to the lessor less the present value of any unguaranteed residual value. The return to the lessor may be higher than for a straight loan.

It can be less costly than other forms of financing. Lease A does not contain a bargain purchase option but the lease term is equal to 90 percent of the estimated economic life of the leased property. Leasing permits the write-off of the full cost of the assets leasing may permit more rapid changes in equipment.

Off-balance-sheet financing Less costly financing 100 financing at fixed rates. However some leasing companies demand that first lease rent should be paid in advance. Lease payments are likely to be lower than finance payments would be an.

264Which of the following would be an advantage of leasing a vehicle. The lessor can repossess the leased equipment where the lessee defaults on payments. Which of the following would be an advantage of leasing a vehicle.

The lessee absorbs the risk of obsolescence. Leases often do not require any down payment. They are good at developing innovative contracts that help avoid accounting problems.

It eliminates a large expense that may drain your cash flow freeing funds for other day-to-day needs. Lease agreements may contain less restrictive provisions than other debt agreements. Cash Flow This is the primary advantage to leasing.

IFRS for leases is more rules-based than US. An advantage of leasing a vehicle would be. For accounting purposes which of the following conditions would not automatically cause a lease to be a financial lease.

Which of the following are advantages of leasing. Interest rates for leasing are always lower. Taxes Leasing almost always allows you to expense your equipment costs meaning that your lease payments can be deducted as business expenses.

The lessor can claim tax relief by way of depreciation. The lessee can purchase the. Determining whether the lease is a sales-type lease or a direct financing lease.

Elimination of the risk of obsolescence. This helps a business to maintain a steady cash-flow profile. Deferred and recognized as income over the term of the lease.

There is a down payment like a purchase. The negative effects of obsolescence may be reduced. The IFRS leasing standard is the subject of over 30 interpretations since its issuance in 1982.

An advantage of leasing is that the lessor does not own the asset and can cancel. Which of the following is an advantage of leasing an asset for the lessee. One of the things that would be an advantage of leasing a vehicle is.

So the lessor interest is fully secured. Which of the following is an advantage of captive leasing companies over the other players in the leasing market. Question 3 Which of the following is an advantage of leasing.

All of the following are advantages of leasing except. All of the following are advantages of leasing except. The lessor may use the funds for other investment opportunities.

Aautomatic ownership interest in the car Bunlimited mileage on the car Cno need to meet credit requirements Dlease payments are likely to be lower than loan payments Eall of the other answers are advantages Blooms. Leasing assets reduces but does not eliminate the risk of obsolescence. The FASBs new accounting standard for.

The ability to use the leased asset as collateral in a bond. Which of the following is not an advantage of leasing as a form of financing. Administration costs may be lower for a lease than for a straight loan.

Any kind of leases anytime. Leasing enables a firm to acquire the use of an asset without making capital investment in buying the asset. The provisions of the agreement may be less stringent than for other debt agreements.

Leasing has a relatively low default risk. Which of the following is an advantage of leasing. All of these answer choices are correct.

Expert answered debnjerry Points 69074 Log in for more information. Advantages of Leasing Balanced Cash Outflow The biggest advantage of leasing is that cash outflow or payments related to leasing are spread out over several years hence saving the burden of one-time significant cash payments. Leasing may have favorable tax advantages.

They have access to low-cost funds allowing them to purchase assets at lower cost. It offers protection against fraud. Depreciation is deductible from income.

Which of the following is an advantage of leasing over the purchase of property for use by a business. Question 1 Which of the following statements is true when comparing the accounting for leasing transactions under US. Ownership automatically passes to the lessee at the end of the lease.

The present value of the minimum lease payments plus the present value of the unguaranteed residual value.

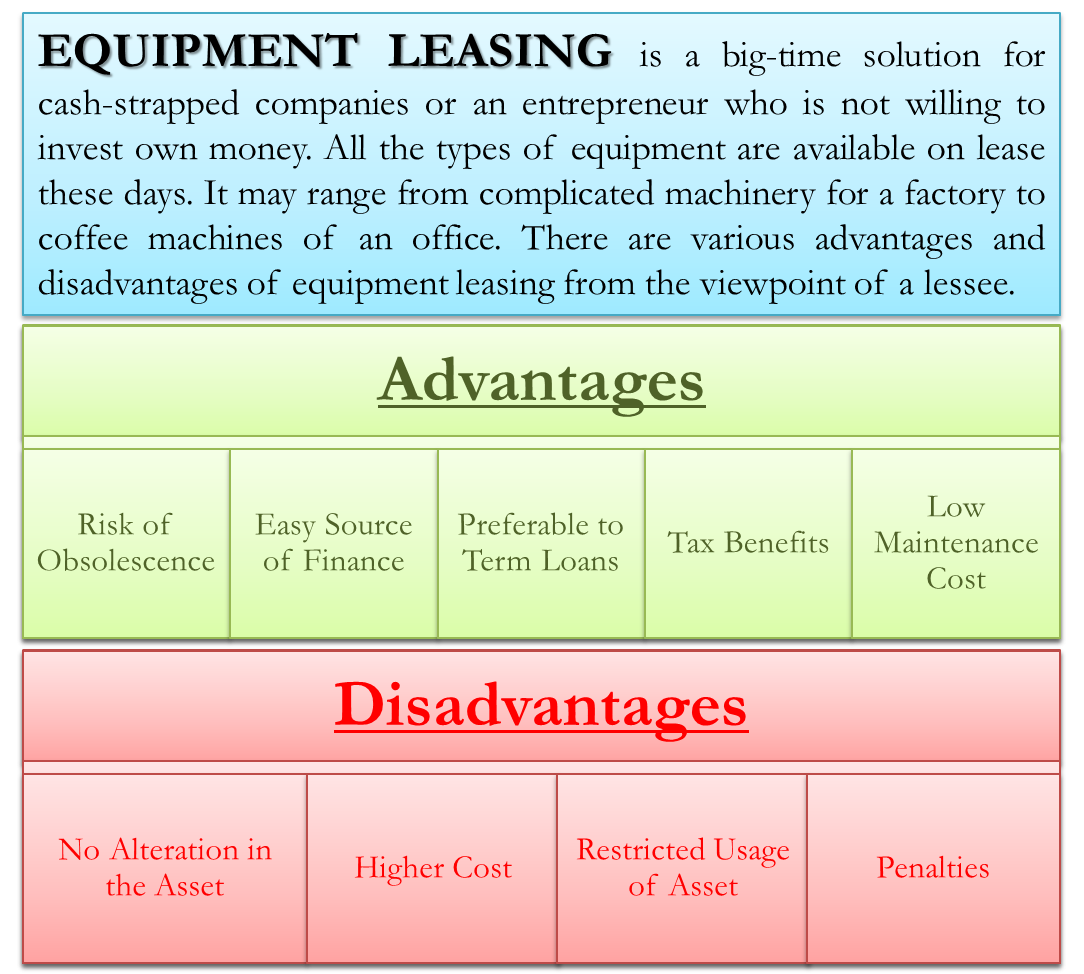

Advantages And Disadvantages Of Equipment Leasing Efm

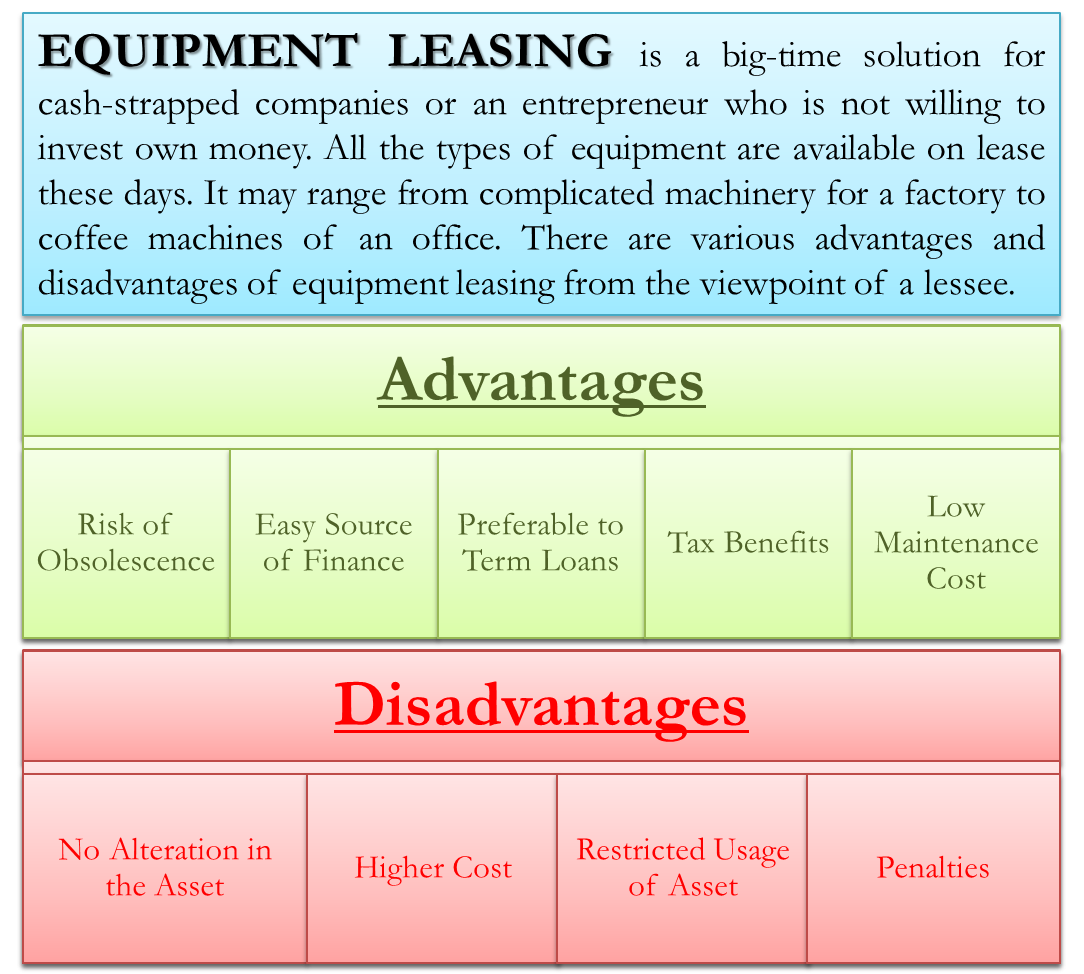

Capital Lease Vs Operating Lease What You Need To Know

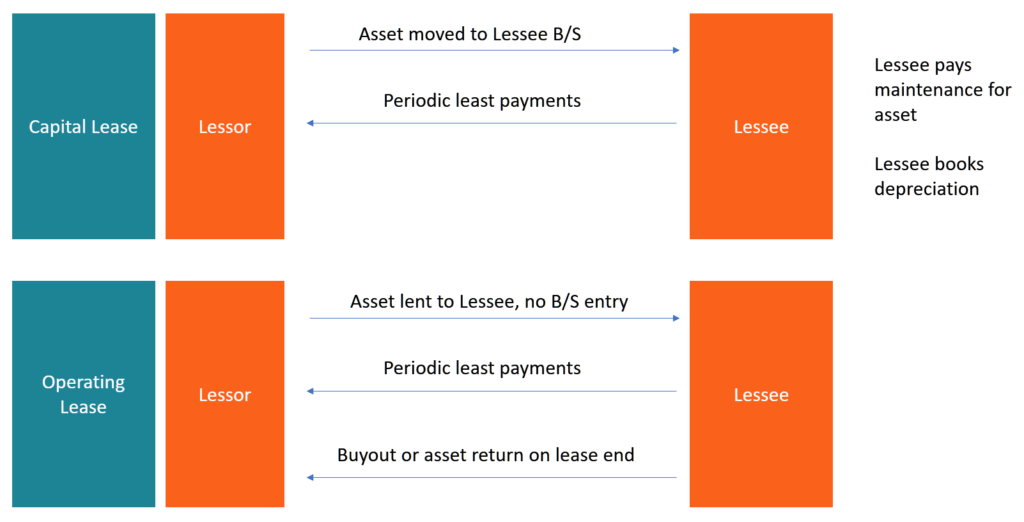

What Is Leasing Advantages And Disadvantages Efinancemanagement

Comments

Post a Comment